Explore All Categories

From cars to cuisine, technology to trends—find what inspires you

Automotive

Cars, vehicles and driving

Business

Business and economy

Cooking

Recipes and culinary arts

Finance & real estate

Finance, investment and property

Health

Health, wellness and wellbeing

Home & living

Home, decor and lifestyle

News

Latest news and current events

Pets

Pets, animals and companions

Sports

Sports, fitness and competition

Technology

Tech, gadgets and innovation

Woman / fashion

Fashion, beauty and lifestyle

Latest articles

Our recent publications

How Are Advancements in the UK's Automotive Sector Revolutionizing Eco-Friendliness?

...

How Can UK Automotive Industry Adapt to Future Challenges?

...

What Are the Recent Innovations in the UK Automotive Industry?

The UK automotive industry is witnessing a wave of innovations that are reshaping the sector's landscape. These UK autom...

Are British Companies Adapting to Global Market Challenges?

British companies confronting the global market encounter a range of global market challenges that significantly affect ...

How can UK businesses attract international investment?

...

What Are the Most Successful Strategies for Expanding a Business in the UK Market?

Expanding a business in the UK requires well-planned business expansion strategies UK tailored to the unique local envir...

How can you create an authentic Lancashire hotpot at home?

Unlocking the heart of an authentic British recipe...

How do you prepare a comforting bubble and squeak?

When preparing traditional bubble and squeak, the choice of ingredients is crucial to achieve its classic flavor and tex...

What Makes a Perfectly Balanced Bubble and Squeak?

A balanced bubble and squeak rests on a harmonious blend of core components—typically leftover potatoes and cabbage comb...

How Does the Current Economic Climate Influence Real Estate Prices in the UK?

Understanding the UK economy in 2024 requires a clear look at key economic indicators such as inflation, GDP growth, and...

How Does the UK's Real Estate Market Impact Investment Opportunities?

The UK real estate market remains dynamic, characterized by fluctuating pricing trends influenced by a mix of demand and...

What Are the Challenges Facing UK Real Estate Financing Today?

Understanding the UK economic outlook is crucial for grasping current real estate financing dynamics. Rising interest ra...

How are lifestyle changes impacting public health trends in the UK?

Lifestyle habits in the UK have undergone significant transformation in recent years. One of the most notable shifts con...

How does the UK promote healthy living to prevent chronic diseases?

National UK public health campaigns play a pivotal role in healthy lifestyle promotion and chronic disease prevention. F...

How Is the UK Encouraging Healthy Lifestyles Among Its Citizens?

The UK government healthy living agenda is central to its public health policy, aiming to reduce lifestyle-related disea...

How Can You Personalize Your UK Rental Space Without Permanent Changes?

Decorating a rental in the UK demands a careful balance between expressing your style and respecting UK landlord rules. ...

What are the best lighting solutions for creating ambiance in UK homes?

Creating the perfect ambient lighting UK environment means selecting lighting that complements the home's style while pr...

What are the top tips for designing a minimalist UK home?

Minimalist home design UK emphasizes simplicity, functionality, and the elimination of unnecessary clutter to create cal...

Discover the best korean novels for all genres

Korean novels offer rich stories spanning genres from literary fiction to suspense and memoir. They reveal unique cultur...

Elevate your arabic proficiency through customized online courses

Achieving fluency in Arabic demands more than generic lessons. Customized online courses tailor instruction to your goal...

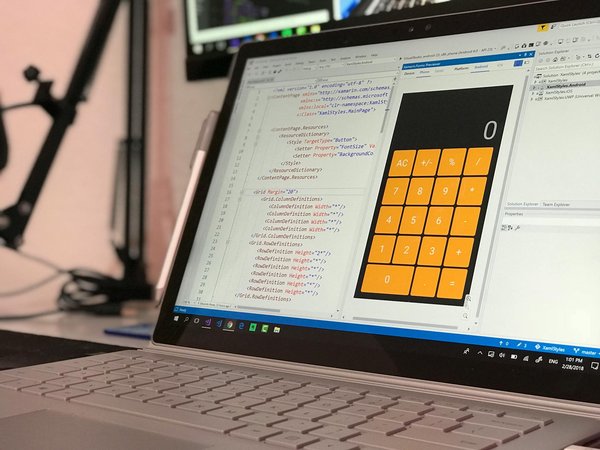

How to learn python for beginners: a practical guide

Python transforms programming education with its clear syntax and versatile applications across web development, data sc...

Luxury real estate Morzine: exclusive chalets and apartments

The magnetism of luxury properties for sale in Morzine has reached unprecedented heights, with recent 2025 data revealin...

Transform your arabic skills with tailored online lessons

Master Arabic efficiently with tailored online lessons designed to meet your individual needs. Whether starting from scr...

Unveiling the new richard prince collection: art reimagined

Richard Prince's latest collection showcases groundbreaking conceptual pieces that redefine contemporary photography. Ac...

What Future Developments Are Expected in the UK's Political Landscape?

...

What are the latest UK pet tech innovations?

The UK pet industry has witnessed a surge in latest UK pet tech innovations, reflecting a growing commitment to improvin...

What Are the Top Qualities to Look for in a Reliable Pet Supplier in the UK?

When selecting reliable pet suppliers UK, it's crucial to prioritize their reputation and credibility within the industr...

Why Do UK Residents Choose Pets for Stress Relief?

...

How do UK schools integrate sports into their curriculum?

The national curriculum in the UK sets clear statutory requirements for physical education (PE), aiming to ensure all pu...

How Do UK Sports Institutions Promote Diversity and Inclusion?

Guiding the path to a more equitable sports culture...